Category: wealth management

The Tao of Wealth Management

The path to success in many areas of life is paved with continual hard work, intense activity, and a day-to-day focus on results. However, for...

Do You Have a Full Line-Up in Investing?

Here at Cogent we try to keep the financial jargon to a minimum. But even where we may succeed, you’re likely to encounter references elsewhere...

Attorneys: Wonder Why You Are Working So Hard?

We are continuing our series for attorneys and how they can overcome their unique financial challenges. Read about Challenge 1: Time is NOT on an attorney’s side. Read...

Imagine Sailing With the Tides

Embarking on a financial plan is like sailing around the world. The voyage won’t always go to plan, and there’ll be rough seas. But the...

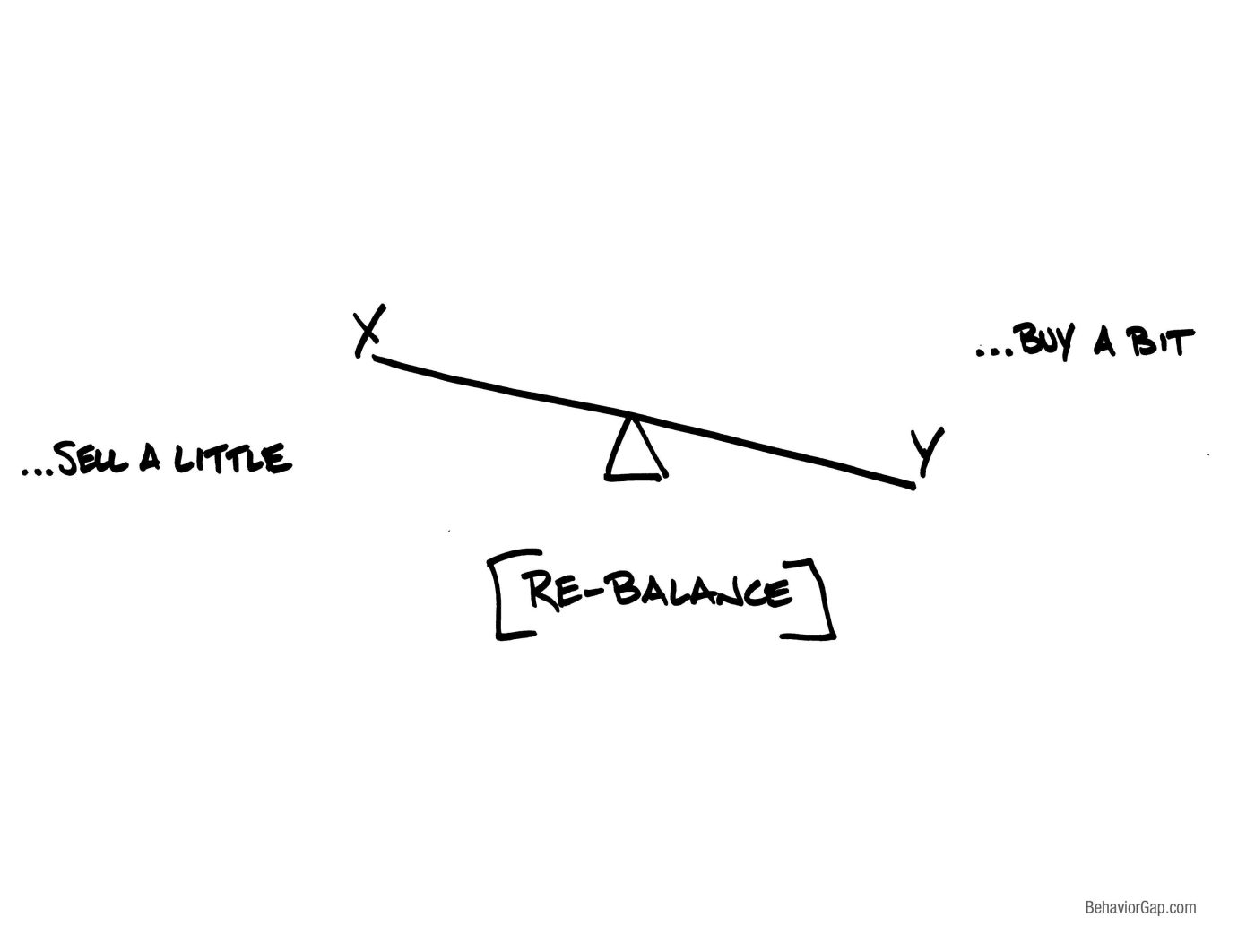

How to Make Rebalancing Valuable to You

If there is a universal investment ideal, it is this: Every investor wants to buy low and sell high. What if we told you there...

What You Can Learn from a Wealth Advisor: Michael Evans’ Story, Part 2

In a previous blog, we shared some of the lessons Michael Evans’ learned in the school of hard knocks. Our goal was the help you...

Do Behavioral Biases Distract You from Making the Best Choices About Your Wealth?

Let’s continue our alphabetic tour of common behavioral biases that distract otherwise rational investors from making best choices about their wealth. Today, we’ll tackle: fear,...

What You Can Learn from a Wealth Advisor: Michael Evans’ Story, Part One

What You Can Learn from a Wealth Advisor: Michael Evans’ Story, Part One You want to be an informed and educated investor. You listen to...

Your Behavioral Biases Are Often the Greatest Threat to Your Financial Well-Being

By now, you’ve probably heard the news: Your own behavioral biases are often the greatest threat to your financial well-being. As investors, we leap before we look....

Getting What You Don’t Pay For

Costs matter. Whether you’re buying a car or selecting an investment strategy, the costs you expect to pay are likely to be an important factor in...

Build Financial Confidence and Focus on What You Love

How do you maintain financial confidence, especially when your investment strategy is being put to the test by challenging markets? A great place to begin...

Why You Need a Revocable Living Trust

You want to build and protect your wealth, and you want to use every tool at your fingertips to make that happen. But when someone...

Success should be a reward - not an obstacle

Your ambitions and struggles are unique, so our wealth solutions go beyond the conventional – they reflect your needs and wants.