Category: tax planning

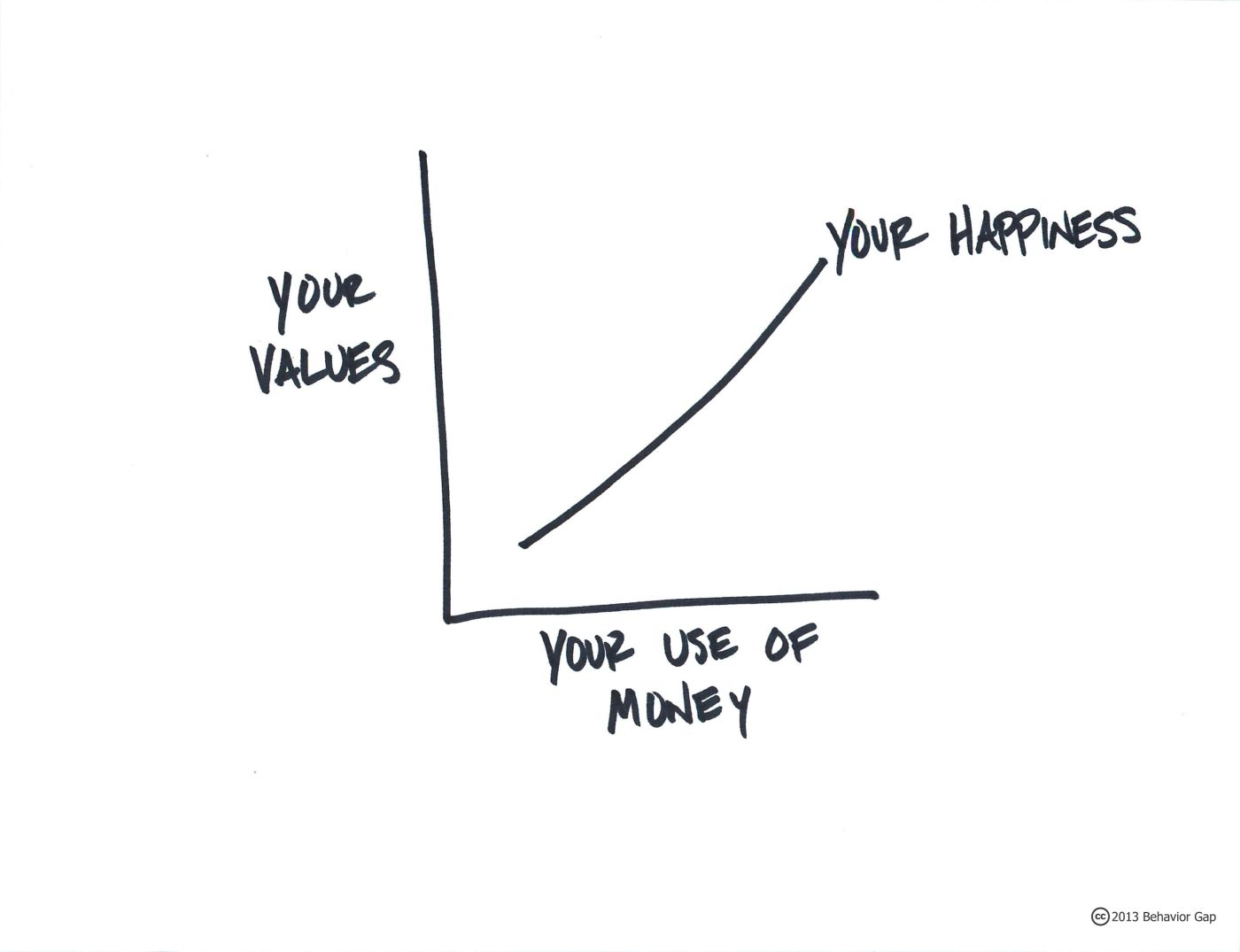

Building Wealth as a Busy Professional

As a busy, thriving professional, your life is going at a breakneck pace. At the same time, you want to build wealth for the future....

Options for Charitable Giving Under New Tax Laws

No matter how the 2017 Tax Cuts and Jobs Act (TCJA) may alter your tax planning, we’d like to believe one thing will remain the...

Coming Up Short in Your Financial Life? 10 Financial Best Practices to Jump-Start Your New Year

Happy Holidays! As we wrap up the current year, one of the best presents you can bestow on yourself and your loved ones is the...

The Art and Science of a Satisfying Retirement

As many families as there are in the world, that’s how many different ways there are to enter into what we collectively call “retirement.” That...

What You Need to Know About Giving

Giving is a big buzzword in American culture these days, especially around the holidays. You want to be a person who gives to others, but...

Pay Fewer Taxes and Boost Returns with Tax-Loss Harvesting

In an alternate universe, perhaps far, far away, there may be markets where no one experiences loss, tax doesn’t eat away at your earnings and...

In Defense of the Home Mortgage: Not all Debt is Bad Debt

We believe it’s time to take a fresh look at a timeless question: Is it better to own your home outright or maintain a mortgage? Given all...

Year-Round Cogent Giving

As we swing into a new year, you may be tempted to assume that the time for charitable giving is behind us. But really, what...

Success should be a reward - not an obstacle

Your ambitions and struggles are unique, so our wealth solutions go beyond the conventional – they reflect your needs and wants.