Category: portfolio management

Wait and You Will Likely Miss Out

With all the warnings about excessively high valuations investors have been getting from gurus and the financial media, it’s not a surprise that a frequent...

What’s the Big Deal about Big Ideas?

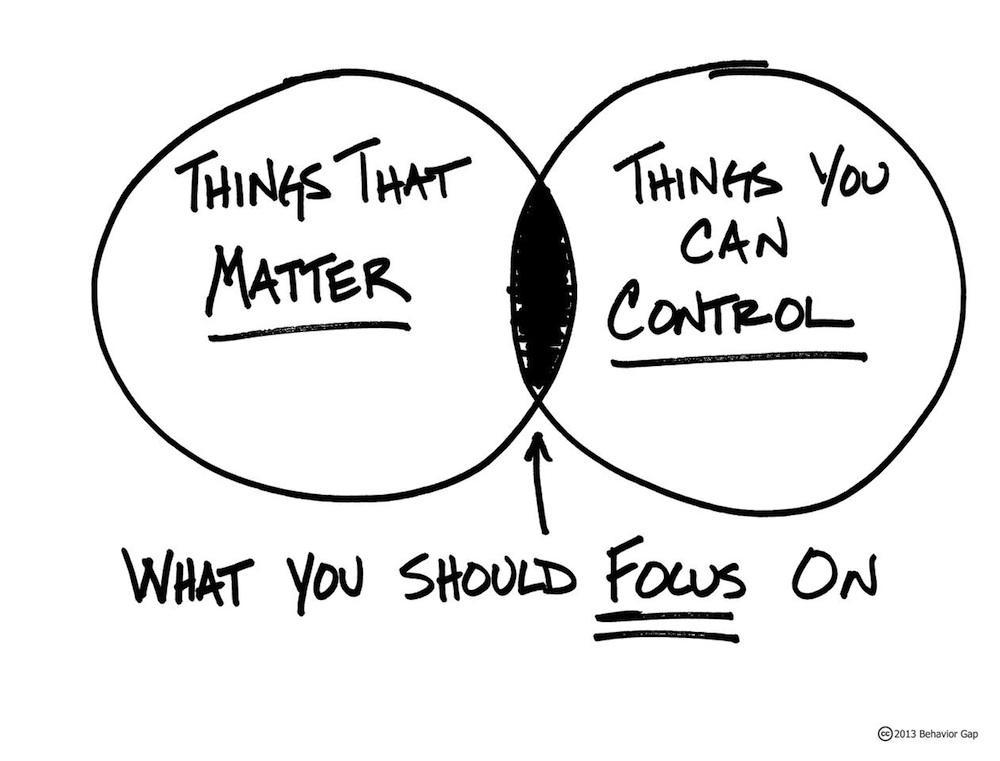

We tend to go on a lot about evidence-based investment management, and how important it is for investors to approach the market from the right...

Let’s Grade the Market Forecasters

The financial media tends to focus much of its attention on stock market forecasts by so-called gurus. They do so because they know that it...

Quit Monkeying Around

In the world of investment management there is an oft-discussed idea that blindfolded monkeys throwing darts at pages of stock listings can select portfolios that...

Misconceptions About the Market: Are You Prepared?

If you enjoy fine literature, we recommend all of Warren Buffett’s annual Berkshire Hathaway shareholder letters, dating back to 1965. While financial reports are rarely the...

What Fewer Stocks Means for Factor Premiums

Jason Zweig, financial columnist for The Wall Street Journal, is one of the truly “good guys” in the world of financial media (by which I...

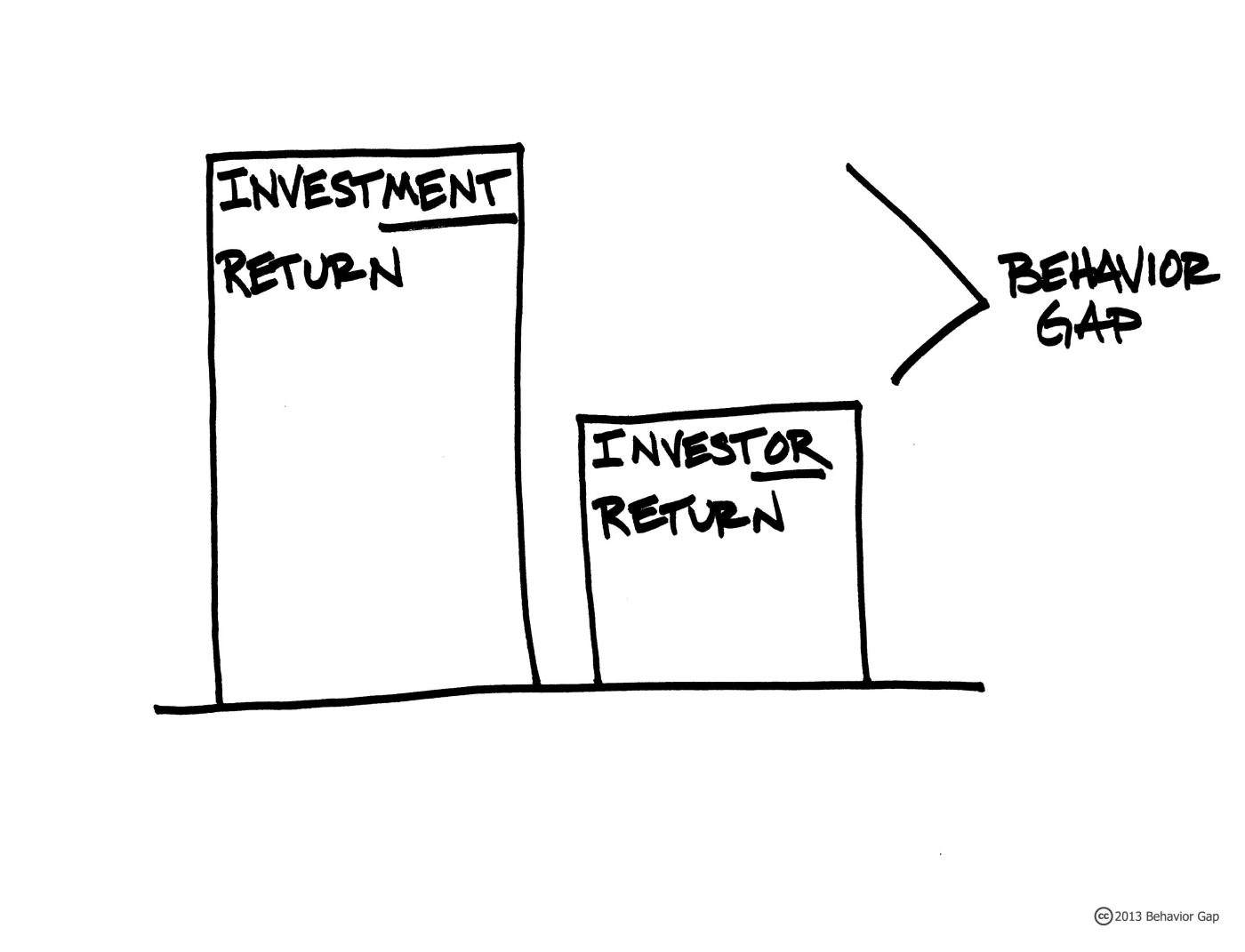

Getting What You Don’t Pay For

Costs matter. Whether you’re buying a car or selecting an investment strategy, the costs you expect to pay are likely to be an important factor in...

The Value of Investing Based on Academic Research

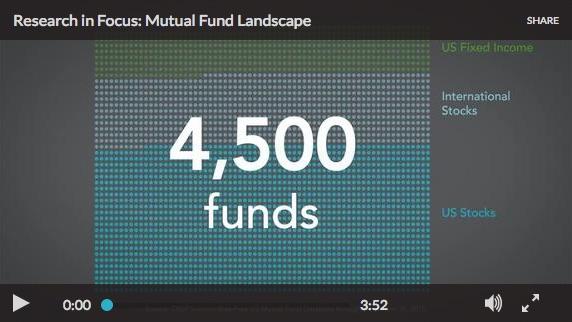

Simplify Your Financial Life with Evidence-Based Investing Featuring our friend and colleague, BAM ALLIANCE Director of Research Larry Swedroe, this video explores the vital role...

When Rates Go Up, Do Stocks Go Down?

Should stock investors worry about changes in interest rates? Research shows that, like stock prices, changes in interest rates and bond prices are largely unpredictable.[1] It...

A Winning Investment Strategy is Available to Any Investor

Baseball season is back in full force and I am always optimistic my team will be more than a winning team – but be “that...

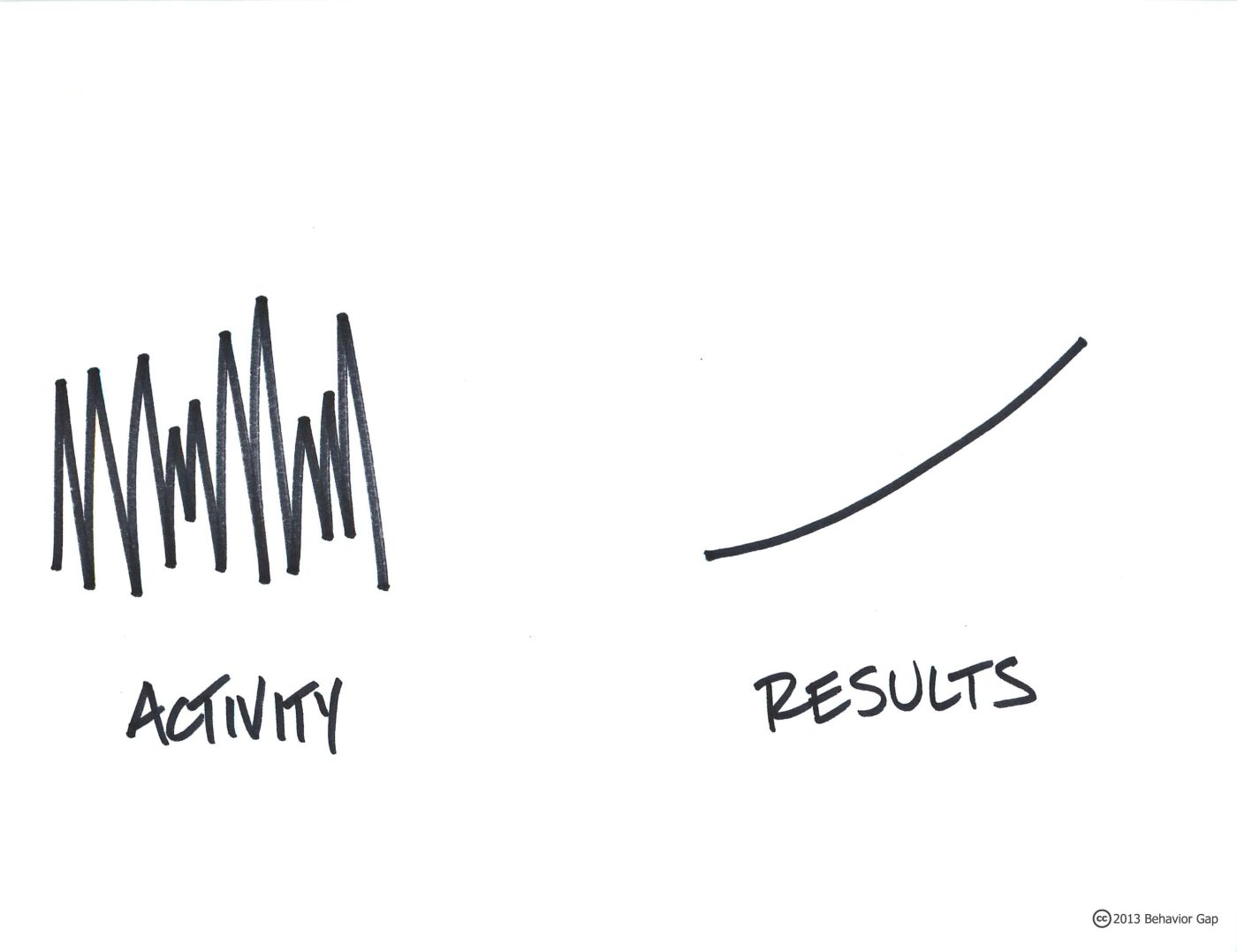

Trader, Should You Fire Yourself as Your Own Wealth Advisor?

I am lucky. From my career as a commodities trader on the Chicago Mercantile Exchange, I count many intelligent, inquisitive and hardworking financial professionals as...

Creating an Investment Policy Statement: Resolving Conflicts

After you and your advisor have analyzed your ability, willingness and need to take risk, you may realize that there are some conflicts that need...

Success should be a reward - not an obstacle

Your ambitions and struggles are unique, so our wealth solutions go beyond the conventional – they reflect your needs and wants.