Category: portfolio management

How Our Survival-Mode Brains Trick Us Into Poor Financial Decisions

We’ll wrap our series, the ABCs of Behavioral Biases, by repeating our initial premise: Your own behavioral biases are often the greatest threat to your financial...

Is As Goes January, So Goes the Year?

As investors ring in the new year, some may see the occasional headline about the “January Indicator” or “January Barometer.” This theory suggests that the...

Cryptocurrency: What Is It All About?

Have you caught cryptocurrency fever, or are you at least wondering what it’s all about? Odds are, you hadn’t even heard the term until recently....

What Behavioral Biases Could be Harming Your Financial Life?

We’re coming in for a landing on our alphabetic run-down of behavioral biases. Today, we’ll present the final line-up: sunk cost fallacy and tracking error...

Should You Have a Catchphrase Investment Strategy?

The financial media is drawn to catchphrases, acronyms, and buzzwords that can be sold as the new thing. FAANG (Facebook, Apple, Amazon, Netflix, and Google)...

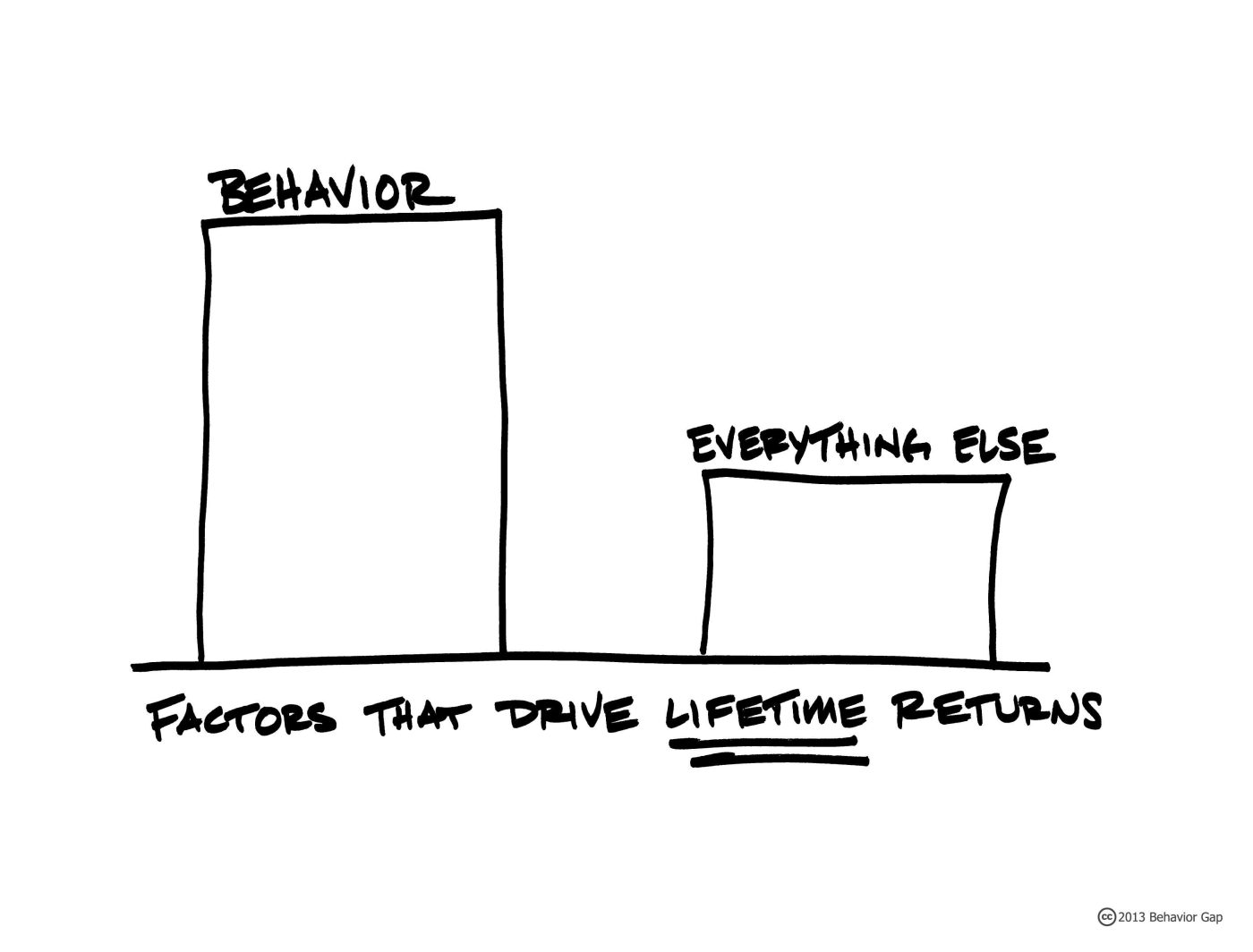

Part 4 – ABCs of Behavioral Biases: Factors That Drive Lifetime Returns

Your own behavioral biases are often the greatest threat to your financial well-being. Things like favoring emotions over evidence – disregarding decades of evidence-based advice...

More Money is Lost Waiting for Corrections Than in Them

We have data for 91 calendar years (or 1,092 months) of U.S. investment returns over the period 1927 through 2016. The average monthly return to...

What Can Impede Your Investing Success? ABCs of Behavioral Biases

There are so many investment-impacting behavioral biases, we could probably identify at least one for nearly every letter in the alphabet. Today, we’ll continue with...

The ABCs of Behavioral Biases – Where Do Your Decisions Go Awry?

Welcome back to our “ABCs of Behavioral Biases.” Today, we’ll get started by introducing you to four self-inflicted biases that knock a number of investors...

How Often Have the Stock Market’s Annual Returns Actually Aligned with Its Long-Term Average?

“I have found that the importance of having an investment philosophy—one that is robust and that you can stick with— cannot be overstated.” —David Booth,...

Why You Should Care About the DOL’s Fiduciary Rule Delay

In late August, the Department of Labor (DOL) announced its intention to delay the final phase-in for its new fiduciary rule from January 1, 2018 to July...

Why Do So Many Investors Keep Playing the Loser’s Game?

The other day, a wealth advisor colleague called to relate his conversation with a prospective client who had questioned the academic basis of our evidence-based...

Success should be a reward - not an obstacle

Your ambitions and struggles are unique, so our wealth solutions go beyond the conventional – they reflect your needs and wants.