Cogent Blog

Our Articles

Here you’ll find our library of personal and business financial articles.

12 Dec 2017

Cogent Strategic Wealth

What You Can Learn from a Wealth Advisor: Michael Evans’ Story, Part One

What You Can Learn from a Wealth Advisor: Michael Evans’ Story, Part One You want to be an informed and educated investor. You listen to...

5 Dec 2017

Cogent Strategic Wealth

Should You Have a Catchphrase Investment Strategy?

The financial media is drawn to catchphrases, acronyms, and buzzwords that can be sold as the new thing. FAANG (Facebook, Apple, Amazon, Netflix, and Google)...

28 Nov 2017

Cogent Strategic Wealth

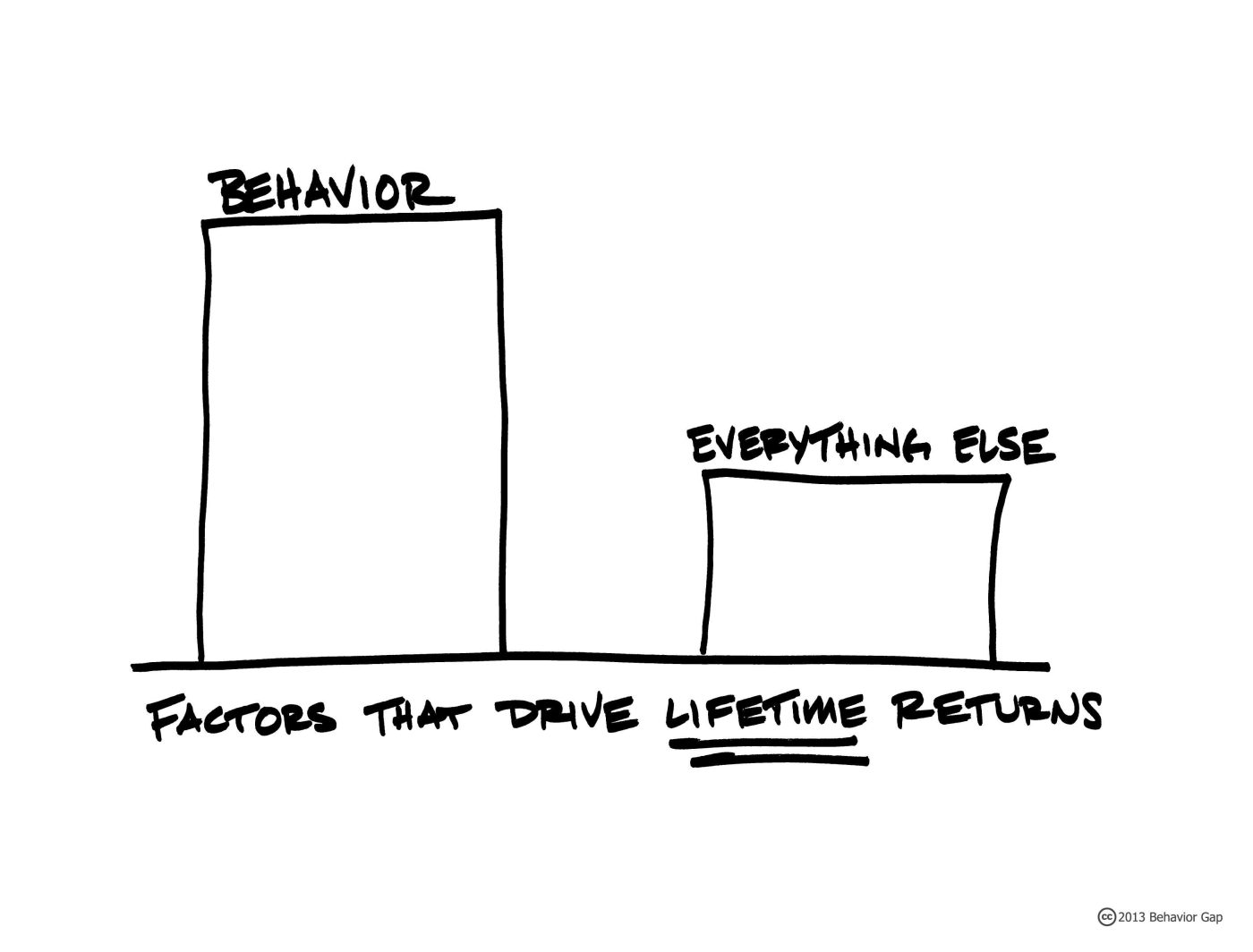

Part 4 – ABCs of Behavioral Biases: Factors That Drive Lifetime Returns

Your own behavioral biases are often the greatest threat to your financial well-being. Things like favoring emotions over evidence – disregarding decades of evidence-based advice...

21 Nov 2017

Cogent Strategic Wealth

More Money is Lost Waiting for Corrections Than in Them

We have data for 91 calendar years (or 1,092 months) of U.S. investment returns over the period 1927 through 2016. The average monthly return to...

14 Nov 2017

Cogent Strategic Wealth

What Can Impede Your Investing Success? ABCs of Behavioral Biases

There are so many investment-impacting behavioral biases, we could probably identify at least one for nearly every letter in the alphabet. Today, we’ll continue with...

9 Nov 2017

Cogent Strategic Wealth

The Art and Science of a Satisfying Retirement

As many families as there are in the world, that’s how many different ways there are to enter into what we collectively call “retirement.” That...

31 Oct 2017

Cogent Strategic Wealth

The ABCs of Behavioral Biases – Where Do Your Decisions Go Awry?

Welcome back to our “ABCs of Behavioral Biases.” Today, we’ll get started by introducing you to four self-inflicted biases that knock a number of investors...

24 Oct 2017

Cogent Strategic Wealth

How Often Have the Stock Market’s Annual Returns Actually Aligned with Its Long-Term Average?

“I have found that the importance of having an investment philosophy—one that is robust and that you can stick with— cannot be overstated.” —David Booth,...

17 Oct 2017

Cogent Strategic Wealth

Your Behavioral Biases Are Often the Greatest Threat to Your Financial Well-Being

By now, you’ve probably heard the news: Your own behavioral biases are often the greatest threat to your financial well-being. As investors, we leap before we look....

12 Oct 2017

Cogent Strategic Wealth

Why You Should Care About the DOL’s Fiduciary Rule Delay

In late August, the Department of Labor (DOL) announced its intention to delay the final phase-in for its new fiduciary rule from January 1, 2018 to July...

3 Oct 2017

Cogent Strategic Wealth

How to Avoid Letting Money Ruin Your Relationships

Money destroys relationships because people can’t compete with money. Money, after all, doesn’t disappoint you, or express disappointment with you. It’s not that money is inherently...

27 Sep 2017

Cogent Strategic Wealth

Why Do So Many Investors Keep Playing the Loser’s Game?

The other day, a wealth advisor colleague called to relate his conversation with a prospective client who had questioned the academic basis of our evidence-based...