Category: retirement planning

How to Assess the Top 5 Risks in Retirement

The single biggest risk retirees face is using up all their resources in retirement. The good news is there are options to mitigate that risk....

When Should You Take Your Social Security?

Ever since President Franklin D. Roosevelt signed off on the 1935 Social Security Act, most Americans have ended up pondering this critical question as they...

Top 3 Action Items on Your Year-End Financial Checklist

by Michael Evans, Founder & Wealth Manager It’s that time of year again. Yes, warm beverages and pumpkin pie come to mind. But so does...

Planning for Inspired Career Transitions: Practice Makes Perfect for Successful Professionals

by Michael Evans, Founder & Wealth Manager If there’s a group who has what it takes to live life on their own terms, it’s high-achieving...

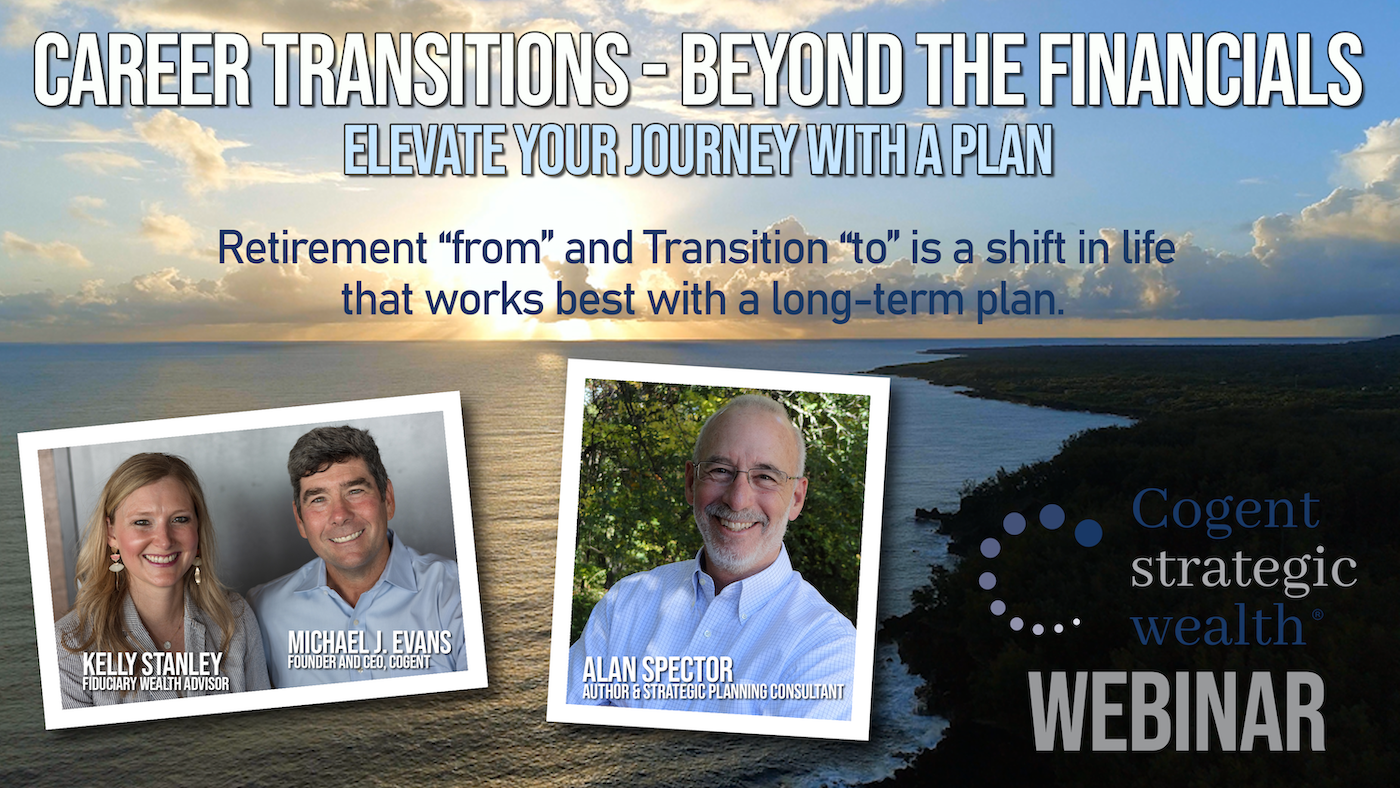

Webinar: Career Transitions – Beyond the Financials

As a high-achieving professional, who is looking to live life on your terms, it is immensely better to follow a life planning process BEFORE you...

12 Bold Financial Moves for the 12 Months in 2022

By Michael Evans, Founder & CEO of Cogent Strategic Wealth Fortune favors the bold, right? As an intrepid entrepreneur, I’ve long embraced this adage. For...

Video: Do Low Fixed Income Yields Have You Worried About Retirement?

Given today’s low-yield environment for fixed income, it makes sense to ask what else you can do when it comes to retirement planning and your...

Tax Planning in Turbulent Times Part 2: Tax-Wise Investment Techniques

In our last piece, we introduced some of the tools of the tax-planning trade. These include tax-sheltered accounts for saving toward retirement, healthcare, and education,...

Tax Planning in Turbulent Times Part 1: The Tools of the Tax-Planning Trade

Whether you’re saving, investing, spending, bequeathing, or receiving wealth, there’s scarcely a move you can make without considering how taxes might influence the outcome. No...

The Illusion of a Linear Life—and Your Financial Plan

“For the simplicity that lies this side of complexity, I would not give a fig, but for the simplicity that lies on the other side of complexity,...

What’s Behind Long-Term Care Insurance and Retirement Planning?

Have you addressed whether you or a loved one might need long-term care (LTC) insurance? If you haven’t, you’re not alone. In all the excitement...

A Retirement Planner Tip: Saving Too Much Too Early in the Year Can Hurt Your Retirement

When it comes to retirement planning and building up the proverbial nest-egg, there are few pieces of advice more universally accepted than “save as much...

Success should be a reward - not an obstacle

Your ambitions and struggles are unique, so our wealth solutions go beyond the conventional – they reflect your needs and wants.