Category: behavioral finance

Is Investing a Science?

The market is unpredictable; however, there is a mountain of data and proven practices when it comes to investing. If you haven’t started investing, you...

Timely Spotlight on the Market’s Peaks and Valleys

Today’s post may be one of my favorites, not only for its direct message, but because of the story behind it. I happened to write...

How Our Survival-Mode Brains Trick Us Into Poor Financial Decisions

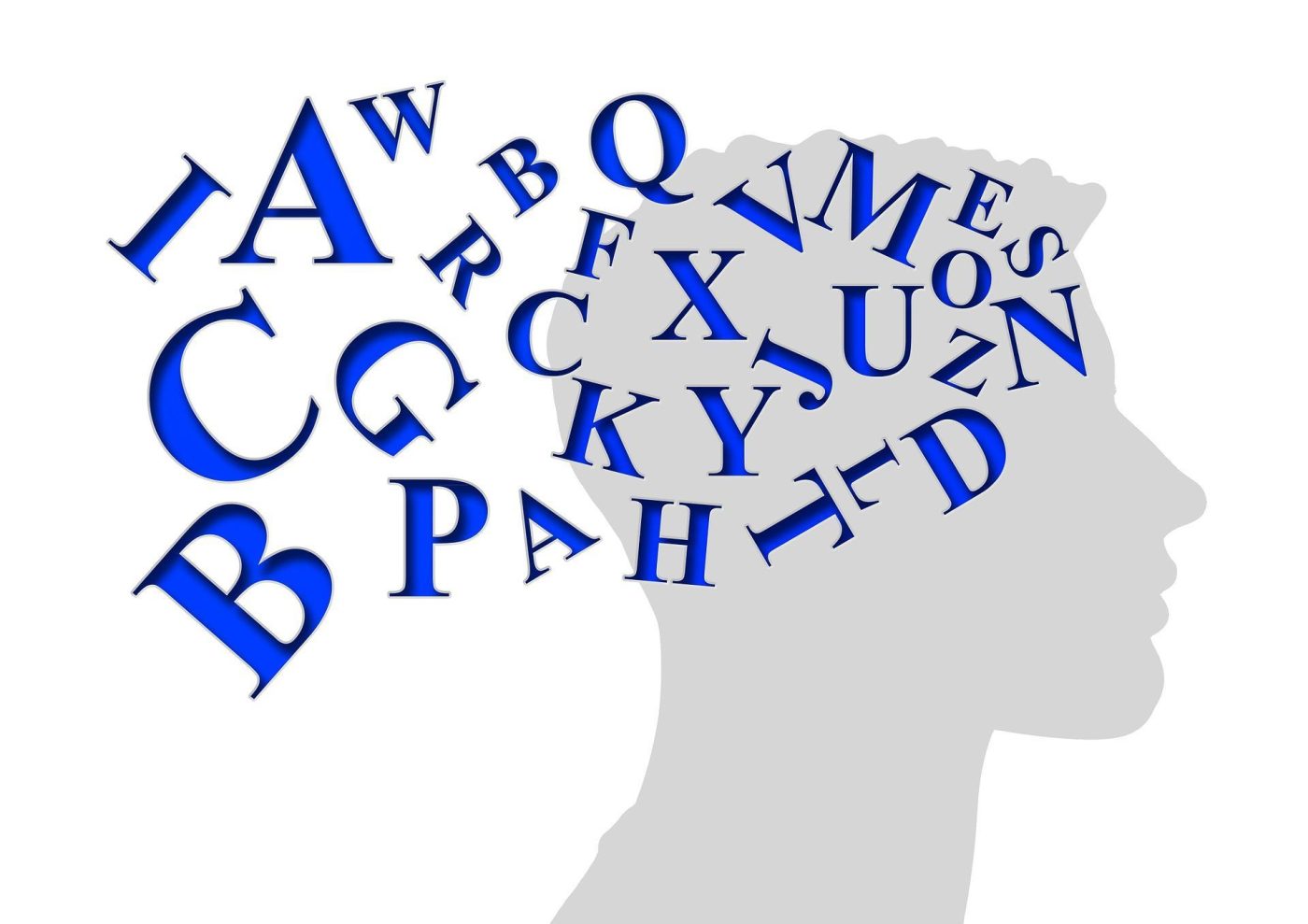

We’ll wrap our series, the ABCs of Behavioral Biases, by repeating our initial premise: Your own behavioral biases are often the greatest threat to your financial...

What Behavioral Biases Could be Harming Your Financial Life?

We’re coming in for a landing on our alphabetic run-down of behavioral biases. Today, we’ll present the final line-up: sunk cost fallacy and tracking error...

Do Behavioral Biases Distract You from Making the Best Choices About Your Wealth?

Let’s continue our alphabetic tour of common behavioral biases that distract otherwise rational investors from making best choices about their wealth. Today, we’ll tackle: fear,...

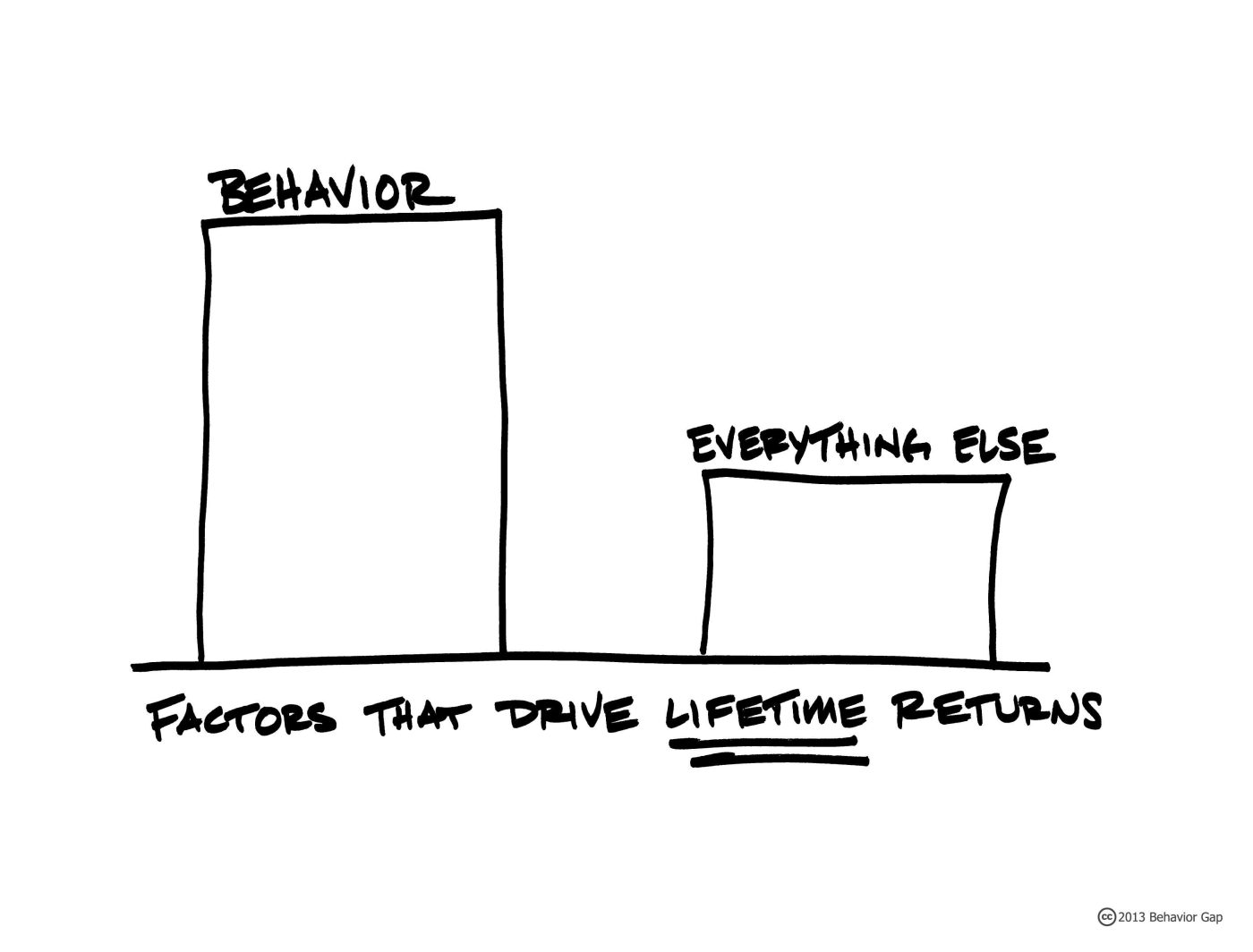

Part 4 – ABCs of Behavioral Biases: Factors That Drive Lifetime Returns

Your own behavioral biases are often the greatest threat to your financial well-being. Things like favoring emotions over evidence – disregarding decades of evidence-based advice...

What Can Impede Your Investing Success? ABCs of Behavioral Biases

There are so many investment-impacting behavioral biases, we could probably identify at least one for nearly every letter in the alphabet. Today, we’ll continue with...

The ABCs of Behavioral Biases – Where Do Your Decisions Go Awry?

Welcome back to our “ABCs of Behavioral Biases.” Today, we’ll get started by introducing you to four self-inflicted biases that knock a number of investors...

Your Behavioral Biases Are Often the Greatest Threat to Your Financial Well-Being

By now, you’ve probably heard the news: Your own behavioral biases are often the greatest threat to your financial well-being. As investors, we leap before we look....

Success should be a reward - not an obstacle

Your ambitions and struggles are unique, so our wealth solutions go beyond the conventional – they reflect your needs and wants.